Assignment-daixieTM为您提供伯明翰大学University of Birmingham Management Accounting 07 33177 计量经济学代写代考和辅导服务!

Instructions:

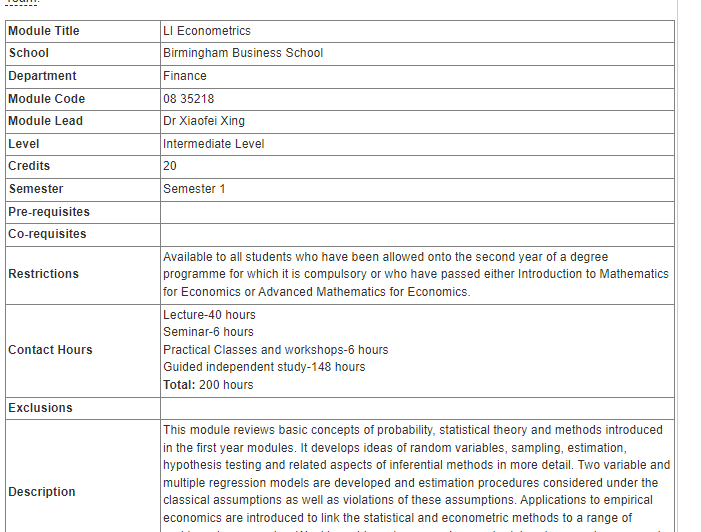

Describing a course/module in statistics and econometrics. The course/module appears to cover basic concepts in probability and statistical theory, as well as more advanced topics such as random variables, sampling, estimation, hypothesis testing, and regression analysis.

The course/module also seems to focus on applying statistical and econometric methods to problems in economics, which suggests that students will learn how to use statistical techniques to analyze economic data and draw conclusions about economic relationships.

It’s great to hear that the course/module includes weekly problem classes and computer laboratory sessions to support the lectures. These types of activities can help students to solidify their understanding of the material and gain practical experience using statistical software.

Overall, it sounds like the course/module will provide students with a strong foundation in statistical and econometric methods and their applications to economics.

Consider $\mathrm{E}[\mathrm{Y} \mid \mathrm{X}]$ where $\mathrm{X}$ is a dummy variable that equals one with probability $\mathrm{p}$ and is zero otherwise. Prove that the CEF and the regression of $\mathrm{Y}$ on $\mathrm{X}$ are the same in this case. Do this by showing that for Bernoulli $\mathrm{X}$ : $$ \begin{aligned} & \alpha=E(Y)-\beta E(X)=E[Y \mid X=0] \\ & \beta=\operatorname{COV}(X, Y) / V(X)=(E[Y \mid X=1]-E[Y \mid X=0]) \end{aligned} $$

To prove that the CEF and the regression of $Y$ on $X$ are the same in this case, we first need to find the regression line for $Y$ on $X$. We can do this by using the standard formula for simple linear regression:

$Y=\alpha+\beta X+\epsilon$,

where $\alpha$ is the intercept, $\beta$ is the slope, and $\epsilon$ is the error term. Since $X$ is a dummy variable that equals one with probability $p$ and is zero otherwise, we can rewrite this equation as:

$\begin{aligned} & Y=\alpha+\beta X+\epsilon=\alpha+\beta p+\epsilon \quad \text { if } \quad X=1 \ & Y=\alpha+\beta X+\epsilon=\alpha+\epsilon \quad \text { if } \quad X=0\end{aligned}$

Notice that $\beta p$ is the difference between $E[Y|X=1]$ and $E[Y|X=0]$. Now, we need to find the values of $\alpha$ and $\beta$ that minimize the sum of squared errors:

$\sum_{i=1}^n\left(Y_i-\alpha-\beta X_i\right)^2$

You are asked to conduct a social experiment to measure the effects of a Job Search Assistance program designed to help unemployed workers find jobs. You will do this by randomly choosing $\mathrm{n}_1$ experimental subjects and $\mathrm{n}_2$ control subjects from a pool of $n_1+n_2=n$ unemployed workers who were selected at random from the population of new Unemployment Insurance claimants in Massachussetts. a. Find the choice of proportion treated, $\mathrm{p}=\mathrm{n}_1 / \mathrm{n}$, that minimizes the sampling variance of the difference in employment rates between treatment and controls. (Treat $n$ as a known constant).

To minimize the sampling variance of the difference in employment rates between treatment and controls, we need to choose the proportion treated, p, such that the variance of the treatment group is equal to the variance of the control group. Since we are assuming that the population of unemployed workers is random, we can assume that the variance of the employment rate is the same for both groups, so we need to choose p such that the variance of the treatment group is equal to the variance of the control group. The variance of the difference in employment rates is given by:

$\operatorname{Var}(\hat{\tau})=\frac{1}{n_1} \frac{1}{n_2}\left[p(1-p)\left(\frac{n_1}{n}\right)\left(\frac{n_2}{n}\right)\left(\frac{1}{n_1-1}+\frac{1}{n_2-1}\right)\right]$

where $\hat{\tau}$ is the estimated treatment effect. Taking the derivative of this expression with respect to p and setting it equal to zero, we get:

$$

\begin{aligned}

& \frac{\partial \operatorname{Var}(\hat{\tau})}{\partial p}= \

& \frac{1}{n_1} \frac{1}{n_2}\left[\left(\frac{n_2}{n}-\frac{n_1}{n}\right)\left(\frac{n_2}{n}\right)\left(\frac{1}{n_1-1}+\frac{1}{n_2-1}\right)-2 p\left(\frac{n_1}{n}\right)\left(\frac{n_2}{n}\right)\left(\frac{1}{n_1-1}+\frac{1}{n_2-1}\right)\right]=

\end{aligned}

$$

0

Solving for p, we get:

$p=\frac{n_1}{n}=\frac{n_2}{n}$

This means that we should treat an equal proportion of the experimental and control groups, which is intuitively sensible.

b. Now assume that it costs $\alpha$ dollars to collect data on anyone in your experiment and that the job search assistance provided to the experimental group costs $\beta$ dollars. You can choose any sample size (n) but you must spend no more than $\mathrm{R}$ dollars on the experiment. Again, maintaining the assumption that there is no treatment effect, solve for the value of $\mathrm{p}$ which minimizes the variance of the treatment/control contrast given the experimenter’s budget constraint. Interpret your result and compare to part (a).

The variance of the difference in employment rates is the same as in part (a), so we can use the same expression for Var($\hat{\tau}$). However, we now need to take into account the costs of the experiment. Let C be the total cost of the experiment, which is equal to $\alpha n + \beta n_1$. We can use the budget constraint to solve for n as a function of p:

$C=\alpha n+\beta n_1=\alpha n+\beta p n \leq R$

Solving for n, we get:

$n \leq \frac{R}{\alpha+\beta p}$

Substituting this expression for n into the expression for Var($\hat{\tau}$), we get:

$\begin{aligned} & \operatorname{Var}(\hat{\tau})=\frac{1}{n_1} \frac{1}{n_2}\left[p(1-p)\left(\frac{n_1}{n}\right)\left(\frac{n_2}{n}\right)\left(\frac{1}{n_1-1}+\frac{1}{n_2-1}\right)\right] \ & =\frac{p(1-p)}{n}\left(\frac{1}{n_1-1}+\frac{1}{n_2-1}\right) \frac{1}{p(1-p)}=\frac{1}{n}\left(\frac{1}{n_1-1}+\frac{1}{n_2-1}\right)\end{aligned}$

Taking the derivative of this expression with respect to p