Assignment-daixieTM为您提供伯明翰大学University of Birmingham Financial Accounting and Accountability 07 32179财务会计代写代考和辅导服务!

Instructions:

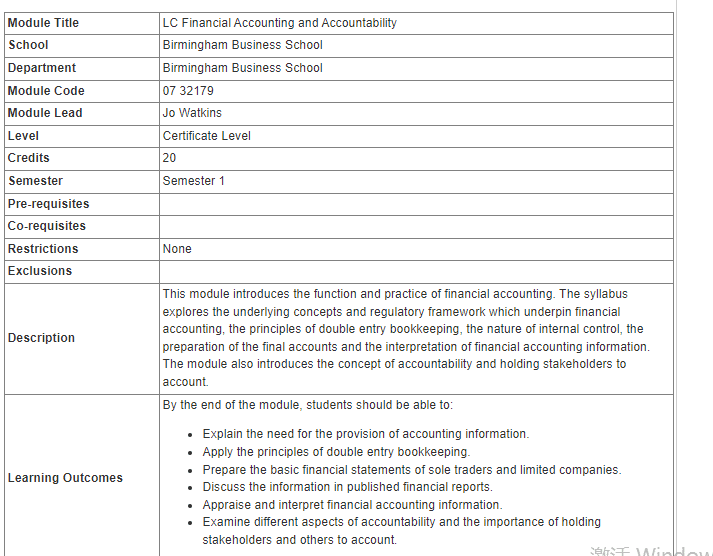

Financial accounting is the process of recording, summarizing, and reporting financial transactions of an organization in order to provide financial information to external stakeholders, such as investors, creditors, and regulatory bodies.

Financial accounting focuses on the preparation of financial statements, including the income statement, balance sheet, and cash flow statement, which summarize an organization’s financial performance and financial position. These financial statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP) and other relevant accounting standards.

Financial accounting also involves the use of double-entry bookkeeping to ensure accuracy and completeness of financial records, and the implementation of internal control procedures to safeguard assets and prevent fraud.

Overall, the purpose of financial accounting is to provide timely and reliable financial information that is useful for decision-making and accountability purposes.

The press release below was issued by Applied Industrial Technologies (NYSE: AIT) on January 17, 2002.

“Applied Industrial Technologies today reported that financial results for its second quarter ended December 31, 2001 were consistent with the company’s guidance provided in a December 11, 2001 news release. The company has taken a charge of $\$ 12,100,000$, or $\$ 0.63$ per share, for impaired goodwill associated with its fluid power businesses. This non-cash charge is being recognized on the company’s statement of consolidated income as the effect of a change in accounting principle related to Goodwill and Other Intangible Assets. This impairment within the fluid power businesses is primarily attributed to the downturn in the industrial economy in the years following the company’s acquisitions. Regarding the goodwill impairment charge, Applied Chairman and Chief Executive Officer David L. Pugh commented, ‘The charge was dictated by early adoption of a new accounting principle (SFAS 142). This new accounting standard requires goodwill and intangible assets with indefinite useful lives to no longer be amortized but instead be tested for impairment.’ ” – Press release courtesy of Applied Industrial Technologies

A. What accounts would be affected as you record the goodwill impairment of $\$ 12,100,000$ ? Use the balance sheet equation below or make a journal entry.

Assets $=$ Liabilities + Contributed Capital + Retained Earnings

$(12,100,000)$

$(12,100,000)$

or Dr. Goodwill impairment charge 12,100,000

Cr. Goodwill

$12,100,000$

B. What is the impact of the impairment loss on the operating cash flow for the firm?

Zero.

Net Income was lower by $12,100,000$; but this non-cash charge was added back to Net Income to get CFO. Therefore, there is no cash impact from the impairment loss.

C. Why do you think managers emphasize that this is a “non-cash” charge?

Managers like to emphasize the non-cash aspect of this type of accounting entry to create

the impression that the charge does not really affect the firm’s valuation. However, the

fact that goodwill is impaired does affect the firm’s valuation. We should not forget that

at some point in the past the company paid cash to acquire firms. The fact that the

company paid more than the fair value of the assets of the target implies that the company

thought the acquisition would create additional cash flows in the future. The impairment

today indicates that the hopes of creating additional cash flows have disappeared. So

clearly, that affects how we view the future cash flow of the firm