Assignment-daixieTM为您提供伯明翰大学University of Birmingham Corporate Finance 07 33172 公司金融学代写代考和辅导服务!

Instructions:

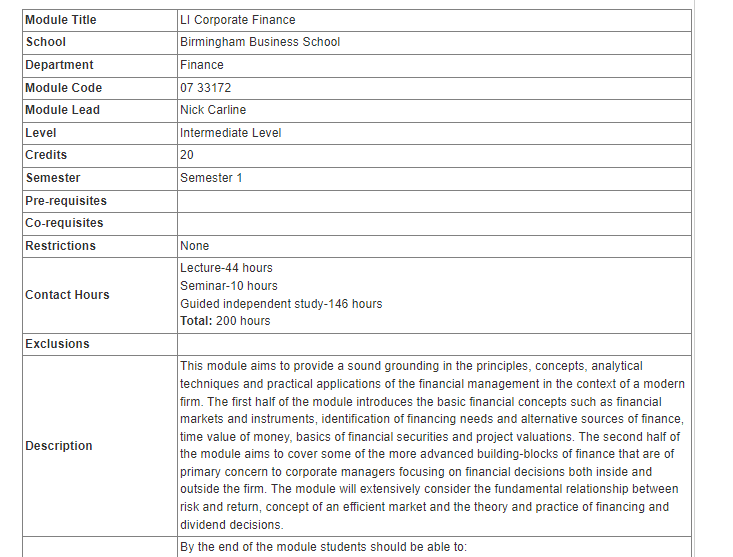

This module provides a comprehensive overview of financial management in the context of modern businesses. The first half of the module covers basic financial concepts such as financial markets and instruments, financing needs, and project valuations. The second half of the module focuses on more advanced topics such as the relationship between risk and return, efficient markets, and financing and dividend decisions.

Overall, this module seems to provide a strong foundation for understanding financial management and its applications in corporate decision-making. Students taking this module will likely gain valuable analytical and practical skills that can be applied in a variety of business contexts.

You own a 10-year U.S. Treasury STRIP. You are certain that the government will repay the face value of the bond. Therefore, the investment is riskless.

A STRIP (Separate Trading of Registered Interest and Principal of Securities) is a type of bond that has its interest payments and principal separated into individual components that can be traded separately. In the case of a 10-year U.S. Treasury STRIP, the interest payments would have been stripped away and the investor would only receive the face value of the bond at maturity.

While U.S. Treasury bonds are considered to be very safe investments, no investment is completely risk-free. There is always the possibility that unexpected events could occur that could affect the repayment of the bond. Additionally, inflation could erode the purchasing power of the bond’s face value over time.

It’s important to consult with a financial advisor or conduct your own research before making any investment decisions.

You own 1,000 call options on Intel stock with a strike price of $\$ 20$. The options mature in April 2002. Intel’s current stock price is $\$ 26.10$, but you are worried that the price may drop to $\$ 10$ – $\$ 15$ by April. If you are confident about this forecast, you should exercise the options now to lock in their value.

To determine whether you should exercise your call options now or wait until April 2002, you need to compare the payoff from exercising the options now versus waiting until April.

If you exercise the options now, you would have to pay the strike price of $$ 20$ per share, for a total cost of $1000 \times 100 \times $ 20 = $ 2,000,000$. However, you would be able to immediately sell the shares at the current market price of $$ 26.10$, for a total revenue of $1000 \times 100 \times $ 26.10 = $ 2,610,000$. This would give you a profit of $$ 610,000$.

If you wait until April and the stock price drops to $$ 15$, then exercising the options would not make sense, as the options would be out of the money (i.e., the strike price is higher than the market price). In this case, you would lose the entire premium paid for the options, which would be $1000 \times 100 \times $ 20 = $ 2,000,000$.

Therefore, if you are confident that the stock price will drop to $$ 10$ – $$ 15$ by April, it would be wise to exercise the options now to lock in their value and secure a profit of $$ 610,000$.

Two bonds with the same time-to-maturity must also have the same duration.

This statement is not necessarily true. The duration of a bond is a measure of its sensitivity to changes in interest rates, and it takes into account the bond’s time-to-maturity, coupon rate, and yield to maturity. While two bonds with the same time-to-maturity could have the same duration, this is not always the case.

For example, consider two bonds with a time-to-maturity of 10 years. Bond A has a coupon rate of 2% and a yield to maturity of 3%, while Bond B has a coupon rate of 5% and a yield to maturity of 6%. These two bonds have the same time-to-maturity, but they will have different durations. Bond A will have a longer duration because its lower coupon rate and yield to maturity make it more sensitive to changes in interest rates.

Therefore, while time-to-maturity is an important factor in determining a bond’s duration, other factors such as coupon rate and yield to maturity must also be taken into account. Two bonds with the same time-to-maturity may have different coupon rates and yields to maturity, which can result in different durations.