Assignment-daixieTM为您提供伯明翰大学University of Birmingham Financial Statement Analysis 07 33828 财务报表分析代写代考和辅导服务!

Instructions:

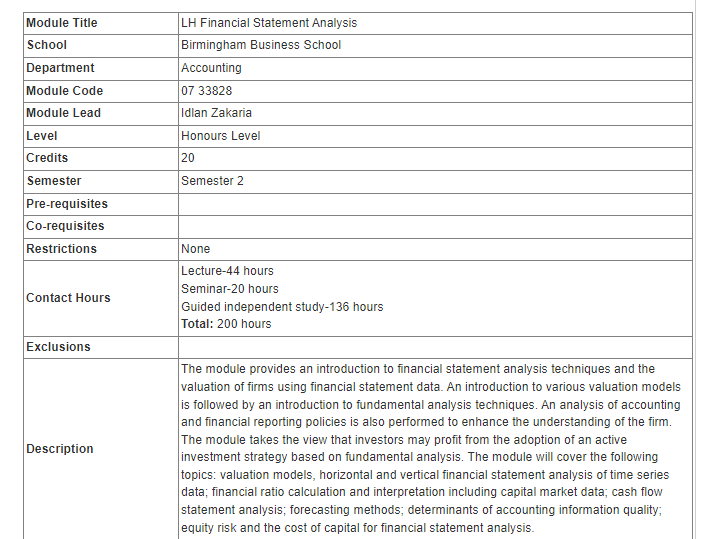

This module appears to provide a comprehensive overview of financial statement analysis techniques and their application in valuation of firms. It covers various valuation models, including fundamental analysis techniques, as well as accounting and financial reporting policies that can impact the interpretation of financial statement data. Additionally, the module aims to provide an understanding of equity risk and the cost of capital for financial statement analysis.

The topics covered in the module include horizontal and vertical financial statement analysis, financial ratio calculation and interpretation, cash flow statement analysis, and forecasting methods. The module also addresses the determinants of accounting information quality and how this can impact the accuracy of financial statement analysis.

Overall, the module takes the view that active investment strategies based on fundamental analysis can be profitable for investors, and provides the necessary tools and techniques for conducting such analysis.

Valanium Inc. is currently trading at a forward $\mathrm{P} / \mathrm{E}$ ratio of 11 . Analysts are projecting its earnings per share for the year ended December 2003 at $\$ 2.10$.

(a) Using a perpetuity model, estimate of the equity cost of capital for Valanium Inc. (Show all calculations).

If one assumes a perpetuity model where next year’s earnings are related to a perpetuity of future free cash flows, then $P / E=1 / r$. Therefore, $r=9.1 \%$

(b) The book value of equity of Valanium at the end of fiscal 2002 was $\$ 15.00$ per share. Calculate abnormal earnings for the fiscal year ended 2003. (Show your calculations)

$\mathrm{AE}{2003}=\mathrm{E}{2003}-\mathrm{r}^{\star} \mathrm{BV}_{\text {t002 }}=2.10-\left(0.091^* 15.00\right)=\$ 0.74$ per share

(c) Assuming a perpetuity in abnormal earnings, calculate the predicted stock price of Valanium Inc. using the residual income (EBO) valuation model.

$$

\mathrm{P}=\mathrm{BV}_0+\mathrm{AE}_1 /(\mathbf{1}+\mathbf{r})+\mathrm{AE}_2 /(1+\mathbf{r})^2+\ldots

$$

If perpetuity in $\mathrm{AE}$, then $\mathrm{P}=\mathrm{BV}_0+\mathrm{AE}_1 / \mathrm{r}=15+0.74 / 0.091=\$ 23.09$