这是一份umass麻省大学 MATH 537作业代写的成功案例

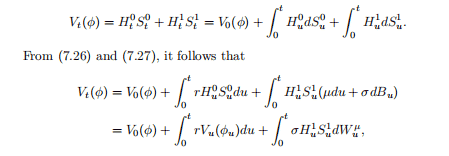

Suppose that $\phi \in S F(0)$. Then, since $\tilde{V}(\phi)$ is a supermartingale, we have

$$

x=V_{0}\left(\phi_{0}\right) \geq E^{\mu}\left(e^{-r T} V_{T}\left(\phi_{T}\right)\right)

$$

If, further, $\phi$ is an $\left(x, f_{T}\right)$-hedge, then

$$

x \geq E^{\mu}\left(e^{-r T} f_{T}\right) .

$$

Consequently, the rational investment price $C\left(T, f_{T}\right)$ satisfies

$$

C\left(T, f_{T}\right) \geq E^{\mu}\left(e^{-r T} f_{T}\right) .

$$

$$

d S_{t}^{1}=S_{t}^{1}\left(\mu d t+\sigma d B_{t}\right),

$$

where $B$ is a standard Brownian motion under $P$. Write $S^{1}(\mu)$ for the solution of $(7.27)$. Then, from $(7.28)$, under the measure $P^{\mu}$, the process $S^{1}(\mu)$ satisfies

$$

d S_{t}^{1}=S_{t}^{1}\left(r d t+\sigma d W_{t}^{\mu}\right),

$$

MATH537 COURSE NOTES :

the rational price for the option $f$ is independent of $\mu$ and is given by

$$

C(T, f)=E\left(e^{-r T} f\left(S_{T}^{1}(r)\right)\right)

$$

where $S^{1}$ is the solution of

$$

d S_{t}^{1}=S_{t}^{1}\left(r d t+\sigma d W_{t}\right) .

$$

Here $W$ is a standard Brownian motion on $(\Omega, \mathcal{F}, P)$.

The wealth process of the corresponding minimal hedge is

$$

V_{t}\left(\phi_{t}^{*}\right)=E\left(e^{-r(T-t)} f\left(S_{T}^{1}(r)\right) \mid \mathcal{F}_{t}\right)

$$