Assignment-daixieTM为您提供利物浦大学University of Liverpool FINANCIAL MATHEMATICS MATH260金融数学代写代考和辅导服务!

Instructions:

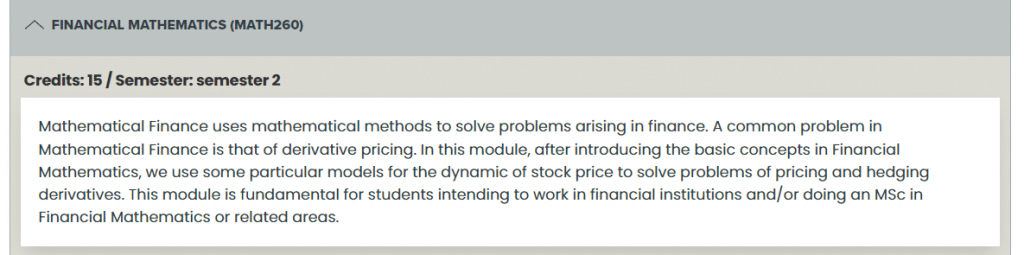

Financial Mathematics is an interdisciplinary field that combines mathematics, statistics, and finance to analyze and solve problems related to financial markets and instruments.

Derivative pricing is a central problem in Financial Mathematics, as it involves determining the fair price of a financial instrument whose value is derived from an underlying asset, such as a stock or commodity. Derivatives include options, futures, swaps, and other financial contracts that can be used to manage risk or speculate on market movements.

To price derivatives, mathematical models are used to describe the behavior of the underlying asset over time. One popular model is the Black-Scholes model, which assumes that the price of the underlying asset follows a geometric Brownian motion and that the market is efficient and frictionless. Other models include stochastic volatility models, jump-diffusion models, and local volatility models, which allow for more complex and realistic dynamics.

Once a model is chosen, various mathematical techniques can be used to derive formulas for the price of derivatives and the optimal hedging strategies to minimize risk. These techniques include Monte Carlo simulations, partial differential equations, and Fourier transform methods.

ROA can be defined as: $\mathbf{R O A}=$ Profit margin $x$ Asset Turnover

Calculate Intel’s ROA, profit margin, and asset turnover for 2001 and 2002. For simplicity, ignore interest income and interest expense in your calculations.

$$

\begin{aligned}

& \text { ROA }=\mathrm{NI} / \text { (Average Total Assets) } \

& \text { 2001: } \quad 1291 / .5(44395+47945)=2.8 \% \

& \text { 2002: } \quad 3117 / .5(44395+44224)=7 \% \

&

\end{aligned}

$$

Profit Margin = NI/Sales

$$

\begin{array}{llll}

\text { 2001: } & & 1291 / 26539 & =4.9 \% \

\text { 2002: } & 3117 / 26764 & =11.6 \%

\end{array}

$$

Asset Turnover $=$ Sales $/($ Average Total Assets $)$

$$

\begin{array}{ll}

\text { 2001: } & 26539 / .5(44395+47945)=57 \% \

\text { 2002: } & 26764 / .5(44395+44224)=60.4 \%

\end{array}

$$

For the years 2001 and 2002, calculate one ratio each year that is indicative of Intel’s short-term liquidity. Briefly comment on Intel’s liquidity.

Current Ratio $=($ Current Assets $) /($ Current Liabilities $)$

$\begin{array}{ll}\text { 2001: } & 17633 / 6570=2.68 \ \text { 2002: } & 18925 / 6595=2.87\end{array}$

Quick Ratio $=($ Cash + Marketable Sec. + Accounts Receivable $) /($ Current Liabilities $)$

2001: $\quad(7970+2607) / 6570=1.61$

$2002: \quad(7404+2574) / 6595=1.51$

Intel has very high liquidity.

For 2002 calculate the Days Inventory held by Intel. What is the cost and/or risk of holding high inventory for Intel?

Inventory Turnover $=\mathrm{COGS} /($ Average Inventory $)=8650 / .5(2276+2253)=3.82$

Days Inventory Held $=365 /($ Inventory Turnover $)=365 / 3.82=95.6$ days

The cost or risk associated with holding high inventory is that prices drop quickly, particularly in Intel’s industry. There is also concern for the obsolescence of finished goods.