这是一份manchester曼切斯特大学 BMAN10552/BMAN10621A作业代写的成功案例

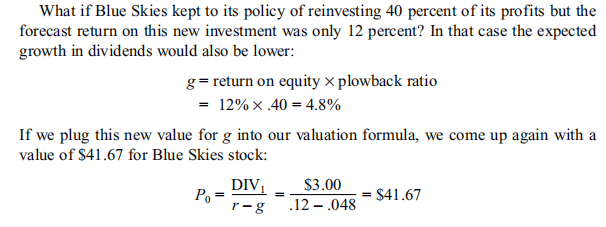

Sure! Take the case of Blue Skies. Suppose that it has 2 million shares outstanding. It plans to pay a dividend of $\mathrm{DIV}_{1}=\$ 3$ a share. So the total dividend payment is 2 million $\times \$ 3=\$ 6$ million. Investors expect a steady dividend growth of 8 percent a year and require a return of 12 percent. So the total value of Blue Skies is

$$

\mathrm{PV}=\frac{\$ 6 \text { million }}{.12-.08}=\$ 150 \text { million }

$$

Alternatively, we could say that the total value of the company is the number of shares times the value per share:

$$

\mathrm{PV}=2 \text { million } \times \$ 75=\$ 150 \text { million }

$$

Of course things are always harder in practice than in principle. Forecasting cash flows and settling on an appropriate discount rate require skill and judgment. As the nearby box shows, there can be plenty of room for disagreement.

BMAN10552 COURSE NOTES :

$$

P_{0}=\frac{\mathrm{DIV}{1}+P{1}}{1+r}=\frac{\$ 5+\$ 105}{1.10}=\$ 100

$$

Since dividends and share price grow at 5 percent,