$$

w_{t} \sim \mathcal{N}\left(0, \sigma^{2} t\right)

$$

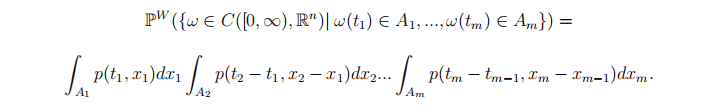

Since the number of tiny little events which can happen between time $s$ and time $t$ is proportional to $t-s$ we assume

$$

w_{t}-w_{s} \sim \mathcal{N}\left(0, \sigma^{2}(t-s)\right), \forall s<t

$$

Also we assume once we know the stock price $S_{s}^{1}$ at some time $s>0$ the future development $S_{t}^{1}$ for $t>s$ does not depend on the stock prices $S_{u}^{1}$ for $u<s$ before $s$. This translates to

$w_{t}-w_{s}$ is independent of $w_{u}, \forall u<s .$

6CCM338A COURSE NOTES :

$$

V_{t_{0}}(\varphi)=\varphi_{t_{0}} \cdot X_{t_{0}}

$$

Now he chooses not to change anything with his portfolio until time $t_{1}$. Then his portfolio at time $t_{1}$ still consists of $\varphi_{t_{0}}$ and hence has worth

$$

V_{t_{1}}(\varphi)=\varphi_{t_{0}} \cdot X_{t_{1}} .

$$

At time $t_{1}$ though he chooses to rearrange his portfolio and reinvest all the money from $V_{t_{1}}(\varphi)$ according to $\varphi_{t_{1}}$. After this rearrangement the worth of his portfolio calculates as

$$

V_{t_{1}}(\varphi)=\varphi_{t_{1}} \cdot X_{t_{1}} .

$$