这是一份manchester曼切斯特大学BMAN21040作业代写的成功案例

If in the previous example the rates were compounded semiannually, then the annuity would be $\$ 2,500\left(5,000 \times \frac{1}{2}\right)$ instead of $\$ 5,000$, the periods would be 8 instead of 4 , the market rate would be $6 \%$ instead of $12 \%$, and the calculation would be as follows:$\times \$ 2,500$

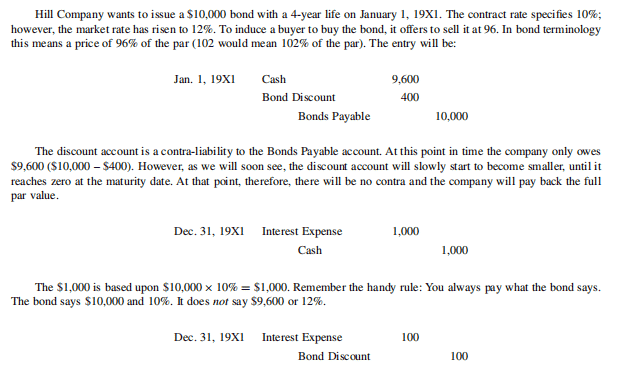

The bond selling price is:

$\frac{15,524}{\$ 46,895}$

BMAN21040 COURSE NOTES :

A $\$ 100,000$ non-interest-bearing note is issued for a machine whose fair market value is $\$ 60,000$. Since it is unlikely for anyone to pay $\$ 100,000$ for an item worth only $\$ 60,000$, we say that the extra $\$ 40,000$ is really “hidden interest.” Recording the machine at $\$ 100,000$ would be overstating the asset Machine and understating Interest Expense. The correct entry should be:

$\begin{array}{lcc}\text { Machine } & 60,000 & \ \text { Discount on Note } & 40,000 & \ \text { Notes Payable } & & 100,000\end{array}$