这是一份 Imperial帝国理工大学 MATH97109作业代写的成功案例

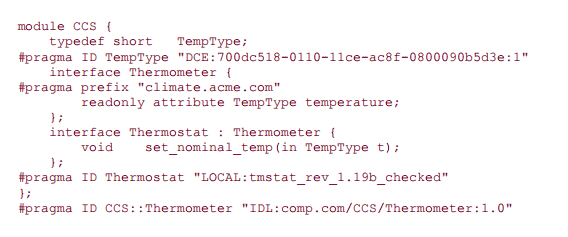

<!-- wp:code -->

for p1 in range (4): # AR order

for q1 in range $(4)$ : # MA order

for p2 in range $(3)$ : # seasonal AR order

for q2 in range $(3): \quad \#$ seasonal MA order

$y$-pred $=$ []

for i, $T$ in enumerate(range (train_size, len (data))):

train_set $=$ data.iloc[T - train_size:T]

model = tsa.sARIMAX (endog=train_set, # model

specification

order $=\left(p 1,0, q^{1}\right)$,

seasonal_orde $r=\left(p^{2}, 0, q^{2}\right.$,

12)). fit ()

preds. iloc $[1,1]$ = mode 1 . forecast $($ steps $=1)[0]$ # $1-$

step ahead forecast

mse = mean_squared_error (preds.y_true, preds.y_pred)

test_results $\left[\left(p 1, q_{1}, p^{2}, q_{2}\right)\right]=$ [np.sqrt (mse),

preds. $y_{-}$true. sub (preds. Y_pred) .std(),

np. mean (aic)]

MATH97109 COURSE NOTES :

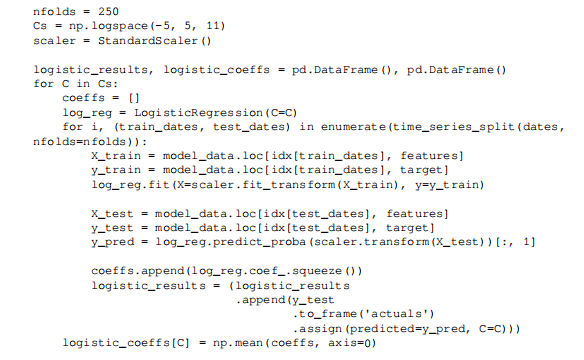

trainsize $=10 * 252$ # 10 years

data = nasdaq_returns. clip (lower=nasdaq_returns. quantile $(.05)$,

upper=nasdaq_returns. quantile(.95))

$T=\operatorname{len}$ (nasdaq returns)

test_results $=\{\}$

for $p$ in range $(1,5)$ :

for $q$ in range $(1,5)$ :

print $\left\{f^{\prime}\{p\} \mid\{q\}^{\prime}\right)$

result $=$ []

for $s, t$ in enumerate (range(trainsize, $T-1))$ :

train_set $=$ data $+i l o c[s: t]$

test_set $=$ data.iloc[t+1] # 1 -step ahead forecast

model = arch_model (y=train_set, $p=p, q=q)$. fit (disp='off')

forecast = model. forecast (horizon=1)

$m u=$ forecast.mean. iloc $[-1,0]$

$\mathrm{var}=$ forecast. $v$ ariance. il oc $[-1,0]$

result. append ([(test_set-mul ${ }^{\star \star} 2$, var] $)$

$d f=$ pd. DataErame (result, columns= ['y_true', 'y_pred'])

test_results $[(p, q)]=$ np.sqrt (mean_squared_error (df. $q$ _true,

df. y_pred) )