Assignment-daixieTM为您提供伯明翰大学University of Birmingham Numeracy, Statistical Analysis and Financial Literacy 07 32180计算能力、统计分析和金融知识代写代考和辅导服务!

Instructions:

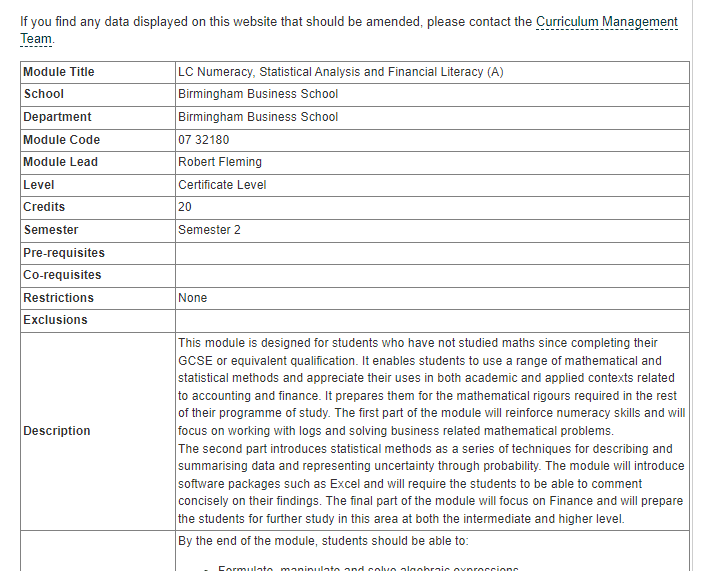

We aims to help students develop their mathematical and statistical skills for use in accounting and finance. The module appears to be divided into three parts:

- Reinforcing numeracy skills and working with logs to solve business-related problems

- Introducing statistical methods for describing and summarizing data and representing uncertainty through probability, and using software packages such as Excel to analyze data and draw conclusions

- Focusing on finance and preparing students for further study in this area.

Q-Aqua Resources is water pipeline and distribution company. It claims that the water supply market is “… most important and, potentially, the fastest growing global resource market over the next 50 years.”

The company reported losses (GAAP net income) for the past 3 years. Q-Aqua currently trades at $\$ 6.55$ per share. In a recent press release, the company highlighted the fact that it had “… positive operating income last year. In addition, sales have been growing at a rate of $25 \%$ per year for the past 2 years. Based on the fact the $Q$-Aqua trades at $a<$ Price-to-Sales> ratio of only 2 and $a<$ Price-to-Operating Income $>$ ratio of only 7 , the management believes that our company is currently undervalued.”

As part of your research, you examined Q-Aqua’s most recent annual financial statement and focused on the supplemental footnotes to the income statement. In particular, the footnotes state that the company “entered into 17 water supply swap transactions in 2001 and 38 water supply swap transactions in 2002. We are conservative in accounting for these swaps in that we fully book for all revenues and expenses related to these transactions each year.” Later in the same footnote, company management states that that “We view the supply capacity received in these swap transactions as building of our overall capital abilities.”

Based on all of the above information, answer the following questions:

a) Why might you question the validity of the company’s reported operating income? Which component?

Operating income may only include revenues from swaps, but not the associated expenses. Therefore, operating income is overstated. Even if the swap expenses are not capitalized, they might be presented below operating income on the income statement.

b) Why might you question the company’s claim that “we believe the company is currently undervalued.” (Focus on the $<$ Price-to-Sales> ratio)

The ratio may use a sales number that includes questionable swap revenues that do not represent real economic value. For the ratio to be a meaningful valuation metric, the Sales number must be related to future expected free cash flows that the firm will generate from its operating business. This is questionable for these types of swaps

Valanium Inc. is currently trading at a forward $\mathrm{P} / \mathrm{E}$ ratio of 11 . Analysts are projecting its earnungs per share for the year ended December 2003 at $\$ 2.10$.

(a) Using a perpetuity model, estimate of the equity cost of capital for Valanium Inc. (Show all calculations).

If one assumes a perpetuity model where next year’s earnings are related to a perpetuity of future free cash flows, then $\mathrm{P} / \mathrm{E}=1 / \mathrm{r}$. Therefore, $\mathrm{r}=9.1 \%$