Assignment-daixieTM为您提供利物浦大学University of Liverpool FINANCIAL MANAGEMENT ACFI204金融管理代写代考和辅导服务!

Instructions:

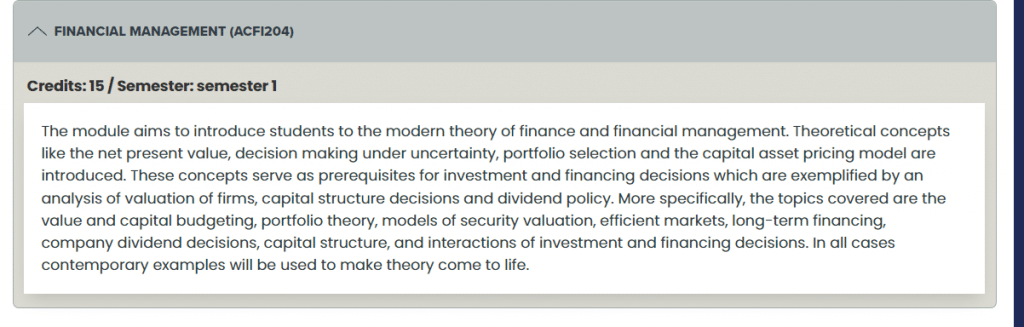

This module is designed to provide students with an understanding of the fundamental concepts and tools of modern finance and financial management. Theoretical concepts such as net present value, decision-making under uncertainty, portfolio selection, and the capital asset pricing model are covered in depth, with a focus on how these concepts can be applied to real-world investment and financing decisions.

The course begins by introducing students to the concept of value and capital budgeting, which is central to financial decision-making. Students will learn how to evaluate potential investments based on their expected future cash flows and how to determine the appropriate discount rate to use in these calculations.

Next, the module covers portfolio theory, which provides a framework for understanding how investors can manage risk and maximize returns by diversifying their investments across a range of assets. Students will learn about the different types of risk that investors face and how to construct efficient portfolios that balance risk and return.

The course then moves on to models of security valuation, which are used to determine the fair value of individual stocks and bonds. Students will learn about the different approaches to valuation, including discounted cash flow models, relative valuation models, and option pricing models.

The module also covers efficient markets, which is the idea that financial markets are highly efficient and that it is difficult to consistently outperform the market through active trading. Students will learn about the different forms of market efficiency and the implications for investment strategy.

Long-term financing is another important topic covered in the module. Students will learn about the different types of long-term financing available to companies, including debt and equity financing, and how to determine the optimal capital structure for a given firm.

The module concludes with an analysis of company dividend decisions and the interaction between investment and financing decisions. Students will learn how companies make decisions about whether to pay dividends to shareholders or reinvest earnings back into the business, and how these decisions can impact the company’s valuation and cost of capital.

Throughout the course, contemporary examples will be used to illustrate the application of theory to real-world financial decisions. By the end of the module, students will have a solid understanding of the key concepts and tools of modern finance and financial management, and how to apply these concepts to make informed investment and financing decisions.

The Federal Reserve (the Fed) is responsible for maintaining low inflation in the U.S. To keep inflation low, the Fed attempts to control short-term interest rates. In this problem, we are going to analyze how the Fed affects the term structure of interest rates. (a) Suppose the inflation rate for the coming year is expected to be $3 \%$. Investors expect inflation to rise to $4 \%$ in the second year and $5 \%$ in the third year. If the expectations hypothesis is true, what is the general shape of the term structure of interest rates? Why?

If the expectations hypothesis is true, the general shape of the term structure of interest rates will be upward sloping. This is because investors expect inflation to rise over time, so the nominal interest rate must also rise to compensate for the expected increase in inflation. Therefore, longer-term bonds will have higher yields than shorter-term bonds to reflect the higher expected inflation in the future.

(b) Assume that the real rate of interest is $1 \%$. In other words, the one-year spot rate is always expected to be $1 \%$ greater than the inflation rate. If the expectations hypothesis is true, what are the one-year forward rates for years 2 and 3 ? Explain. For this problem, you may use the approximate formula relating the real rate to the nominal rate.

According to the approximate formula relating the real rate to the nominal rate, we have:

Nominal interest rate = Real interest rate + Expected inflation rate

For the first year, the nominal interest rate would be 4% (1% real rate + 3% expected inflation rate). Using the expectations hypothesis, we can assume that the one-year forward rate for year 2 is equal to the expected nominal interest rate for year 2, which is 5% (4% current year nominal interest rate + 1% expected real rate + 4% expected inflation rate for year 2).

Similarly, we can assume that the one-year forward rate for year 3 is equal to the expected nominal interest rate for year 3, which is 6% (5% forward rate for year 2 + 1% expected real rate + 5% expected inflation rate for year 3).

A two-year, $8 \%$ coupon bond with a face value of $\$ 1,000$ has a current price of $\$ 1,000$. Assume that the bond makes annual coupon payments. The term structure of interest rates is flat. (a) What is the bond’s yield-to-maturity?

Since the bond is priced at par ($$1,000$), the yield-to-maturity is equal to the coupon rate of $8%$ per annum.

This is because when the bond is priced at par, the coupon payments and the face value payment provide a total return to the investor equal to the yield-to-maturity. In this case, the annual coupon payment is $8% \times $1,000 = $80$, and the face value payment is $$1,000$.

Therefore, the yield-to-maturity of the bond is $8%$ per annum.