Assignment-daixieTM为您提供利物浦大学University of Liverpool BEHAVIOURAL ECONOMICS ECON251行为经济学代写代考和辅导服务!

Instructions:

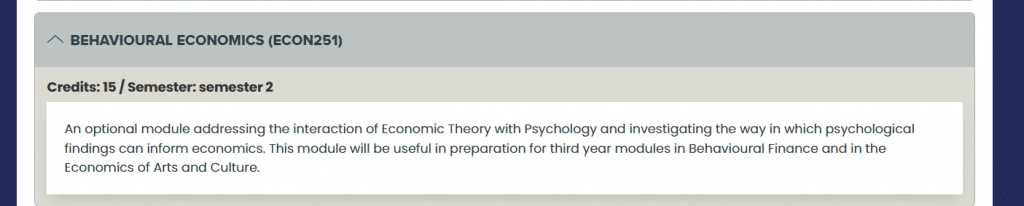

The interaction of economic theory with psychology has become an important area of research in recent years. This optional module would explore the various ways in which psychological findings can inform economics, with a particular focus on the implications for financial decision-making and the economics of arts and culture.

The module would begin by introducing students to the key concepts and theories in both economics and psychology. This would include an overview of classical economic theory, as well as a discussion of the various psychological factors that influence decision-making, such as cognitive biases and social influence.

From there, the module would explore the ways in which psychological findings can be applied to economics. This might involve looking at how cognitive biases can affect financial decision-making, or how social influence can shape consumer behavior. The module might also investigate how economic theory can be used to understand and predict human behavior in different contexts, such as auctions or negotiations.

Throughout the module, students would be encouraged to think critically about the relationship between economics and psychology. They would be asked to consider the strengths and limitations of both disciplines, as well as the ways in which they can complement one another.

By the end of the module, students would have gained a deeper understanding of the complex interplay between economics and psychology. They would be well-prepared to tackle more advanced modules in behavioral finance and the economics of arts and culture, as well as to apply their newfound knowledge to a range of real-world scenarios.

Assume that a consumer’s utility function is given by:

$$

u\left(x_1, x_2, x_3\right)=B_1 \log \left(x_1-\alpha_1\right)+B_2 \log \left(x_2-\alpha_2\right)+B_3 \log x_3

$$

and that the consumer faces consumer prices $\mathrm{q}_1$ and $\mathrm{q}_2$, with the price of good three normalized to unity. The consumer’s endowment (y) is measured in units of good three.

(a) Find the indirect utility function and expenditure function corresponding to this set of preferences. This is the famous Stone-Geary utility function, the basis for the linear expenditure system in demand analysis.

The Lagrangian corresponding to the consumer’s constrained utility maximization problem is given by:

$$

L=\beta_1 \log \left(x_1-\alpha_1\right)+\beta_2 \log \left(x_2-\alpha_2\right)+\beta_3 \log \left(x_3\right)+\mu\left(y-\left(q_1 x_1+q_2 x_2+x_3\right)\right)

$$

The FOC’s are respectively:

$$

\begin{gathered}

\frac{\beta_1}{x_1-\alpha_1}=\mu q_1 \

\frac{\beta_2}{x_2-\alpha_2}=\mu q_2 \

\frac{\beta_3}{x_3}=\mu \

y-\left(q_1 x_1+q_2 x_2+x_3\right)=0

\end{gathered}

$$

Let us solve for $x_1$. The multiplier is:

$$

\mu=\frac{\beta_1}{q_1\left(x_1-\alpha_1\right)}

$$

Let us eliminate $x_2 q_2$ from the B.C. using the 2nd FOC from above:

$$

x_2=\alpha_2+\frac{\beta_2}{\mu q_2}=\alpha_2+\frac{\beta_2 q_1\left(x_1-\alpha_1\right)}{q_2 \beta_1}

$$

Therefore, we have:

$$

q_2 x_2=q_2 \alpha_2+\frac{\beta_2}{\mu}=q_2 \alpha_2+\frac{\beta_2 q_1\left(x_1-\alpha_1\right)}{\beta_1}

$$

Similarly we can eliminate $x_3$ from the B.C.:

$$

x_3=\frac{\beta_3}{\mu}=\frac{\beta_3 q_1\left(x_1-\alpha_1\right)}{\beta_1}

$$

The B.C. is thus:

$$

y=q_1 x_1+q_2 \alpha_2+\frac{\beta_2 q_1\left(x_1-\alpha_1\right)}{\beta_1}+\frac{\beta_3 q_1\left(x_1-\alpha_1\right)}{\beta_1}=x_1\left(q_1+\frac{\beta_2 q_1}{\beta_1}+\frac{\beta_3 q_1}{\beta_1}\right)+q_2 \alpha_2-\alpha_1\left(\frac{\beta_2 q_1}{\beta_1}+\frac{\beta_3 q_1}{\beta_1}\right)

$$

Using now that $\sum \beta_i=1$, we get:

$$

y=\frac{q_1 x_1}{\beta_1}+q_2 \alpha_2-\alpha_1 q_1 \frac{1-\beta_1}{\beta_1}

$$

Thus:

$$

x_1=\beta_1 \frac{y}{q_1}-\frac{q_2}{q_1} \alpha_2 \beta_1+\alpha_1\left(1-\beta_1\right)=\alpha_1+\frac{\beta_1}{q_1}\left(y-q_1 \alpha_1-q_2 \alpha_2\right)

$$

Generalizing this formula also gives us the Marshallian demands $x_2$ :

$$

x_2=\alpha_2+\frac{\beta_2}{q_2}\left(y-q_1 \alpha_1-q_2 \alpha_2\right)

$$

Let us plug in the Marshallian demands into the utility function to get the indirect utility function:

$$

v(q, y)=\beta_1 \log \left(\frac{\beta_1}{q_1}\left(y-q_1 \alpha_1-q_2 \alpha_2\right)\right)+\beta_2 \log \left(\frac{\beta_2}{q_2}\left(y-q_1 \alpha_1-q_2 \alpha_2\right)\right)+\beta_3 \log \left(\frac{\beta_3}{q_3}\left(y-q_1 \alpha_1-q_2 \alpha_2\right)\right)

$$

Using that $\log (x y)=\log x+\log y$, we get the indirect utility function:

$$

v(q, y)=\log \left(y-q_1 \alpha_1-q_2 \alpha_2\right)-\beta_1 \log q_1-\beta_2 \log q_2+\sum \beta_i \log \beta_i

$$

Replacing $y=e(q, u)$ in the indirect utility function allows us to find the expenditure function:

$$

u=\log \left(e(q, u)-q_1 \alpha_1-q_2 \alpha_2\right)-\beta_1 \log q_1-\beta_2 \log q_2+\sum \beta_i \log \beta_i

$$

Solving for the expenditure function gives:

$$

e(q, u)=\exp \left(u+\beta_1 \log q_1+\beta_2 \log q_2-\sum \beta_i \log \beta_i\right)+q_1 \alpha_1+q_2 \alpha_2=q_1 \alpha_1+q_2 \alpha_2+e^u q_1^{\beta_1} q_2^{\beta_2} \beta_1^{-\beta_1} \beta_2^{-\beta_2} \beta_3^{-\beta_3}

$$

(b) Use your results from (a) to find an analytic expression for the compensating variation. In the special case of $\alpha_1=\alpha_2=.50$ and $\beta_1=\beta_2=.40$, find the $\mathrm{CV}$ associated with a tax reform that changes $\left(\mathrm{q}_1, \mathrm{q}_2, \mathrm{y}\right)$ from $(1,1,5)$, a setting with no taxes, to $(2.0,1.5,5)$. Find the efficiency cost of the tax reform, defined as $\mathrm{CV}$ minus the compensated revenue associated with this

(b) CV: The compensating variation equals the change in the expenditures assessed at initial utility level:

$$

C V=e\left(q^{\prime}, u\right)-e(q, u)=\left(q_1^{\prime}-q_1\right) \alpha_1+\left(q_2^{\prime}-q_2\right) \alpha_2+e^u \beta_1^{-\beta_1} \beta_2^{-\beta_2} \beta_3^{-\beta_3}\left(q_1^{\prime \beta_1} q_2^{\prime \beta_2}-q_1^{\beta_1} q_2^{\beta_2}\right)

$$

This expression only depends on known parameters except for $e^u$ which can be expressed from the expenditure function as a function of income $y=e(q, u)$ :

$$

q_1^{-\beta_1} q_2^{-\beta_2} \beta_1^{+\beta_1} \beta_2^{+\beta_2} \beta_3^{+\beta_3}\left(y-q_1 \alpha_1-q_2 \alpha_2\right)=e^u

$$

Combining the last 2 expressions gives:

$$

C V=\left(q_1^{\prime}-q_1\right) \alpha_1+\left(q_2^{\prime}-q_2\right) \alpha_2+q_1^{-\beta_1} q_2^{-\beta_2} \beta_1^{+\beta_1} \beta_2^{+\beta_2} \beta_3^{+\beta_3}\left(y-q_1 \alpha_1-q_2 \alpha_2\right) \beta_1^{-\beta_1} \beta_2^{-\beta_2} \beta_3^{-\beta_3}\left(q 1^{\beta_1} q 2^{\beta_2}-q_1^{\beta_1} q_2^{\beta_2}\right)

$$

This simplifies into:

$$

C V=\left(q_1^{\prime}-q_1\right) \alpha_1+\left(q_2^{\prime}-q_2\right) \alpha_2+\left(y-q_1 \alpha_1-q_2 \alpha_2\right)\left(\left(\frac{q_1^{\prime}}{q_1}\right)^{\beta_1}\left(\frac{q_2^{\prime}}{q_2}\right)^{\beta_2}-1\right)

$$

Let us plug in the prices and income, to get $C V\left(q, q^{\prime}, y\right)=0.5+0.25+(4)\left((2)^{0.4}(1.5)^{0.4}-1\right)=0.75+4 *$ $\left(3^{\frac{4}{10}}-1\right)=2.9574$

The EV would be given by the same formula as (1) but with $u^{\prime}$ rather than $u$. Since prices rise, utility drops $u^{\prime}<u$ and hence the $\mathrm{EV}$ is smaller than the CV.

Without referencing to the formula, we could use that:

- CV is the area to the left of the Hickian demand curve related to old utility/EV is the area to the left of the Hickian demand curve related to new utility

- Demanded quantities increase in utility (normality)

- Utility drops

to conclude that the CV is bigger than the EV. To find the efficiency cost, note that the compensated revenue equals

From Shephard’s lemma we know that Hicksian demand equals the price derivative of the expenditure function:

$$

\begin{aligned}

& h_1(q, u)=\alpha_1+e^u\left(\frac{q_1}{\beta_1}\right)^{\beta_1-1}\left(\frac{q_2}{\beta_2}\right)^{\beta_2}\left(\frac{1}{\beta_3}\right)^{\beta_3}=1.73 \

& h_2(q, u)=\alpha_2+e^u\left(\frac{q_1}{\beta_1}\right)^{\beta_1}\left(\frac{q_2}{\beta_2}\right)^{\beta_2-1}\left(\frac{1}{\beta_3}\right)^{\beta_3}=2.135

\end{aligned}

$$

The compensated revenue equals the tax times the expenditures is thus equal to $R\left(q^1, u_0\right)=1.73+0.5 *$ $2.135=2.81$ and since $\mathrm{CV}=2.96$ we find an efficiency cost of 0.13826 .

Consider a consumer endowed with an exogenous income $\mathrm{y}$. If there is an initial price vector $\mathrm{p}^0$ and a post-reform price vector $\mathrm{p}^1$, we know that both the compensating variation $C V\left(\mathrm{p}^0, \mathrm{p}^1, \mathrm{y}\right)$ and the equivalent variation $E V\left(\mathrm{p}^0, \mathrm{p}^1, \mathrm{y}\right)$ provide a meaningful welfare ranking of $\mathrm{p}^0$ and $\mathrm{p}^1$. Suppose now, however, that the status quo $\mathrm{p}^0$ is being compared with two possible price vectors $\mathrm{p}^1$ and $\mathrm{p}^2$. For instance, the government considers which goods to tax, starting from a no tax situation.

(a) Show that the consumer is better off under $p^1$ than under $p^2$ if and only if $E V\left(p^0, p^1, \mathrm{y}\right)<\mathrm{EV}\left(\mathrm{p}^0, \mathrm{p}^2, \mathrm{y}\right)$. Thus, the measures $E V\left(p^0, \mathrm{p}^1, \mathrm{y}\right)$ and $E V\left(\mathrm{p}^0, \mathrm{p}^2, \mathrm{y}\right)$ can be used not only to compare these two price vectors with $\mathrm{p}^0$, but also to determine which of them is better for the consumer.

Consider a consumer endowed with an exogenous income $y$. If there is an initial price vector $p^0$ and a postreform price vector $p^1$, we know that both the compensating variation $C V\left(p^0, p^1, y\right)$ and the equivalent variation $E V\left(p^0, p^1, y\right)$ provide a meaningful welfare ranking of $p^0$ and $p^1$. Suppose now, however, that the status quo $p^0$ is being compared with two possible price vectors $p^1$ and $p^2$. For instance, the government considers which goods to tax, starting from a no tax situation.

(a) Show that the consumer is better off under $p^1$ than under $p^2$ if and only if $E V\left(p^0, p^1, y\right)<E V\left(p^0, p^2, y\right)$. Thus, the measures $E V\left(p^0, p^1, y\right)$ and $E V\left(p^0, p^2, y\right)$ can be used not only to compare these two price vectors with $p^0$, but also to determine which of them is better for the consumer.

We want to compare $u^1 \equiv v\left(p^1, y\right)$ and $u^2 \equiv v\left(p^2, y\right)$. Using the equivalent variation, we have

$$

\begin{aligned}

E V\left(p^0, p^1, y\right)-E V\left(p^0, p^2, y\right) & =\left(e\left(p^1, u^1\right)-e\left(p^0, u^1\right)\right)-\left(e\left(p^2, u^2\right)-e\left(p^0, u^2\right)\right) \

& =y-e\left(p^0, u^1\right)-y+e\left(p^0, u^2\right) \

& =e\left(p^0, u^2\right)-e\left(p^0, u^1\right)

\end{aligned}

$$

Since the expenditure function is increasing in utility, a comparison of equivalent variations will provide the correct welfare ranking.