这是一份liverpool利物浦大学ACFI304的成功案例

Alternatively, the net capital stock is replaced by a linear time trend $t$ that should account for the technological change.

Formally, the cost function used here is given by

$$

\begin{aligned}

C\left(w, x^{f}, y^{r}, s, t\right)=& y_{s, t}^{r} \times\left[\sum_{i=1}^{n} \sum_{j=1}^{w} \beta_{i j}\left(w_{i} w\right){s, t}^{1 / 2}+\sum{i=1}^{n} \sum_{j=1}^{w} \gamma_{i j}\left(w_{i} f\right){s, t}\right.\ &+\sum{i=1}^{n} \delta_{i}(w){s, t} \times t+\sum{i=1}^{n} \delta_{i 2}\left(w w_{s, t} \times t^{2}\right]

\end{aligned}

$$

where $C$ is the real total variable cost, $s$ is the industry ( $s=1$ : banking, $s=2$ : insurance), and $\beta_{i j}, \gamma_{i j}, \delta_{i j}$ are unknown parameters.

Applying Shephard’s lemma to the above cost function, we derive the conditional (with respect to output and the quasi-fixed factors) demand equations for the variable labour inputs $x_{f}^{v}, i \in{U S, M S, H S}:\left(x_{i}^{v}\right){s t}=\left(\partial \mathrm{C}(\cdot) / \partial w{i}\right){s, t^{-}}$The division of these factor demands by real value added yields a system of input-output coefficients of the following form: $$ (\pi){i, t} \equiv\left(\frac{x_{i}^{v}}{y^{r}}\right){s, t}=\sum{j=1}^{n} \beta_{i j}\left(w / w_{i}\right){s, t}^{1 / 2}+\sum{j=1}^{m} \gamma_{i j}\left(x_{j}^{f}\right){s, t}+\delta{f 1} \times t+\delta_{i 2} \times t^{2}

$$

ACFI304 COURSE NOTES :

Each bank $i$ faces the decision whether or not to adopt technology $g$, by maximizing its utility. Since the amount of customers per bank is fixed, this is equivalent to maximizing its utility per customer: $U i\left(s_{f}, s_{g}, t_{p}\right)$. This utility is a function of three parameters: (1) the market share of bank $i$, denoted $s_{i} ;(2)$ the combined share $s_{g}$ of other banks using $g$; and (3) $t_{e}$, which represents the technology used by bank $i$, where $t=g$ if the bank adopts $g$ and $t=f$ otherwise. Now:

$$

\begin{array}{ll}

U_{l}\left(s_{p}, s_{g}, f\right)=0 & \text { if the bank does not adopt } g \

U_{l}\left(s_{p}, s_{g}, g\right)=\left(s_{i}+s_{g}\right) b-c & \text { if it does adopt } g .

\end{array}

$$

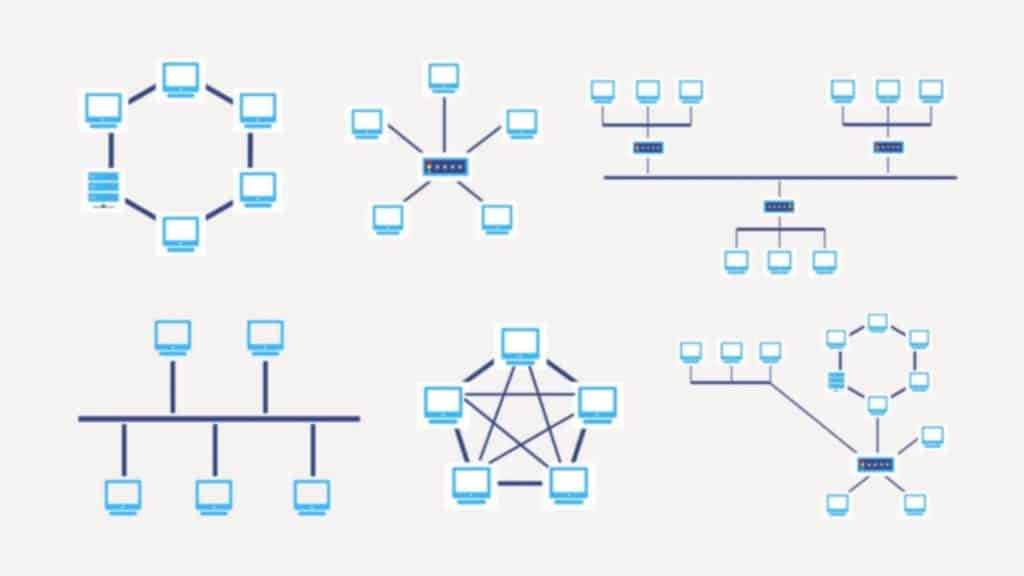

Since by definition $b>c, s_{g}=1$ (all banks adopt $g$ ) is always a Nash-equilibrium: unilateral deviation (dropping or not adopting $g$ ) from this equilibrium will lower a bank’s utility from a positive number to zero. Now let $s_{1}$ be the market share of the largest bank. Then there is a second equilibrium where $s_{g}=0$ (no bank adopts $g$ ) if:

$$

s_{1} b-c<0 \Leftrightarrow s_{1}<c / b

$$