Assignment-daixieTM为您提供伯明翰大学University of Birmingham Public Economics 07 32226公共经济学代写代考和辅导服务!

Instructions:

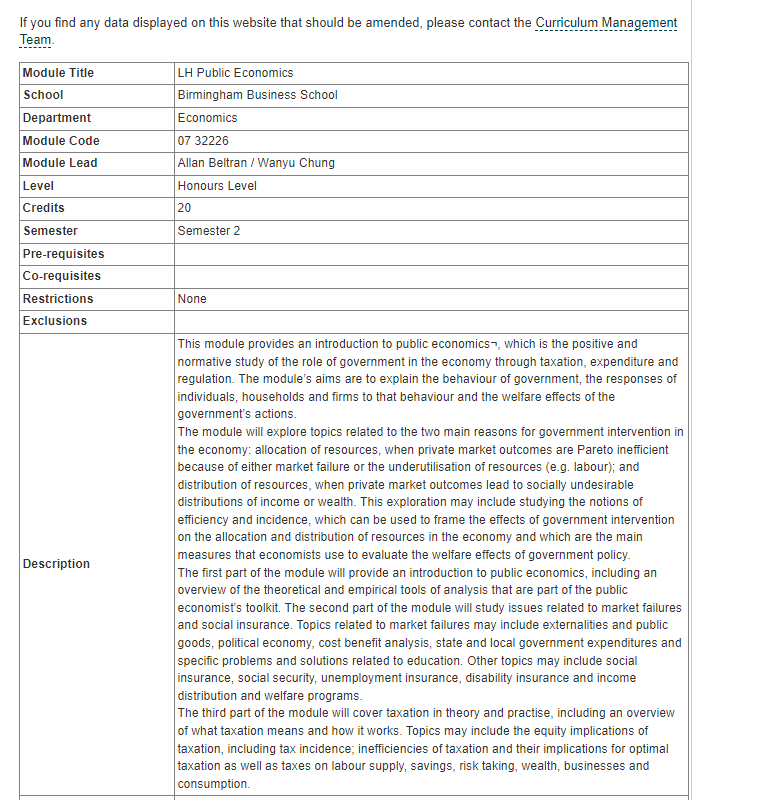

Public economics is a branch of economics that deals with the study of how government policies affect the economy, including taxation, government spending, and regulation. It seeks to understand the incentives and constraints faced by both governments and individuals in the public sector and to evaluate the efficiency and equity of government policies.

Positive analysis in public economics involves understanding how the government and individuals behave and how they respond to different policies. For example, a positive question in public economics might be “How will an increase in taxes on cigarettes affect the consumption of cigarettes?”

Normative analysis, on the other hand, involves evaluating policies and making recommendations on how to improve them. For example, a normative question in public economics might be “Should the government increase spending on education, and if so, how should it be funded?”

Overall, the goal of public economics is to understand the role of government in the economy and to evaluate whether government policies achieve their intended objectives while minimizing unintended consequences.

Assume that cross-sectional data on household demand for gasoline $\left(\mathrm{g}{\mathrm{i}}\right)$, with households located in different states and facing different gasoline tax burdens, suggests a demand curve of the form: $$ \begin{array}{cc} \ln \mathrm{g}{\mathrm{i}}= & -1.50-0.40 * \ln \mathrm{q}{\mathrm{i}}+0.80 \ln \mathrm{y}{\mathrm{i}} \

(0.20)(0.07) & (0.20)

\end{array}

$$

where $q_i$ denotes the tax-inclusive price of gasoline facing household $i$ and $y_i$ denotes household i’s income in dollars. Assume that the producer price of gasoline is $\$ 3.00$.

(a) Do the parameter estimates make sense? What units might $\mathrm{g}_{\mathrm{i}}$ be measured in?

(a) Do estimates make sense? They make sense: a $1 \%$ increase in gas prices decreases gas consumtion by $0.4 \%$ and a $1 \%$ increase inincome increases gas consumption by $0.8 \%$. To infer the units, the relatively large price elasticity suggest we are in the medium to long run. Let us plug in some reasonable numbers for the consume price $\left(q_i=5 \$\right)$ and income $\left(y_i=50,000 \$ /\right.$ year $)$ to get $g_i=673$ per year. This suggests the units are gallons per year.

(b) For a household with income of $\$ 50,000$, find the Harberger triangle estimate of the deadweight loss from a specific tax of $\$ 1.00 /$ gallon of gasoline.

(b) Harberger DWL from specific tax? Demand drops from $g_0=825.8$ to $g_1=736.1$. Hence the simple triangular DWL is:

$$

D W L=\frac{1}{2}(825.8-736.1)=44.87

$$

Note, we could also use $D W L=\eta_D \frac{g_1 \tau^2}{p_1 2}$ which gives 49.07

(c) Using the indirect utility function and expenditure function corresponding to this demand curve, find the exact welfare loss (CV – Hicksian Revenue) associated with a $\$ 1$ /gallon for a household with an income of $\$ 50,000$. How does this compare with the triangle estimate in (b)?

(c) Exact welfare loss? Demand has a constant elasticity. Thus we follow Hausman (1981). He solves the PDE implied by Roy’s identity to find the indirect utility function (see equation (21)):

$$

v\left(p_1, y\right)=-e^{z y} \frac{p_1^1+\alpha}{1+\alpha}+\frac{y^{1-\delta}}{1-\delta}

$$

where $\alpha=-0.4$ and $\delta=0.8$.

Inverting the indirect utility function gives the expenditure function (equation (22)):

$$

e\left(p_1, \bar{u}\right)=\left[(1-\delta)\left(\bar{u}+e^{z y} \frac{p_1^{1+\alpha}}{1+\alpha}\right)\right]^{\frac{1}{1-6}}

$$

Utility at the old prices is $v(3,50000)=29.09$. Hence we can compute CV as

$$

C V=e(4,29.09)-e(3,29.09)=783

$$

To compute compensated revenue (as in Diamond and McFadden), we get the Hicskian demand:

$$

h(4,29.09)=x(4, e(4,29.09))=745

$$

This, the DWL thus equals:

$$

D W L=C V-R(4,29.09)=C V-1 * h(4,29.09)=783-745=38

$$