这是一份 Imperial帝国理工大学 BUSI70210作业代写的成功案例

$$

R O I_{A}=\frac{\sum_{t=1}^{n} C F_{t}-P_{0}}{P_{0}}+n

$$

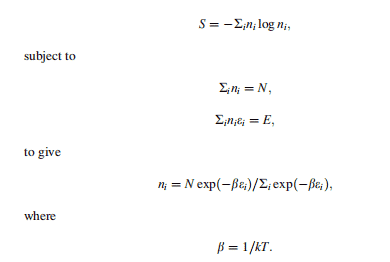

Although its concept is quite simple, this arithmetic mean return does not account for the timing of cash flows nor the compounding of investment profits. An alternative average return is the geometric mean return computed as follows:

$$

R O I_{g}=\sqrt[n]{\prod_{t=1}^{n}\left(1+r_{i}\right)}=1

$$

where $r_{t}$ is the return on investment for a single period $t$. Another return measure which more appropriately accounts for the timing of investment cash flows is internal rate of return (IRR), which is that value for $r$ which solves the following:

$$

N P V=0=-P_{0}+\sum_{\mathrm{r}=1}^{n} \frac{C F_{t}}{(1+r)^{t}}

$$

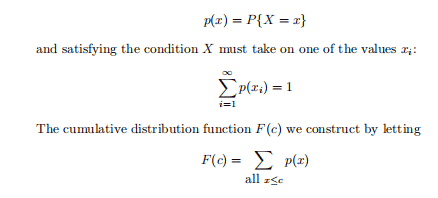

BUSI70210 COURSE NOTES :

$$

E[R]=\sum_{i=1}^{n} R_{i} \cdot P_{i}

$$

The statistical concept of variance is an indicator of uncertainty associated with the investment. It accounts for all potential outcomes and associated probabilities:

$$

\sigma^{2}=\sum_{i=1}^{n}\left(R_{i}-E[R]\right)^{2} P_{i}

$$

Unfortunately, in many real-world scenarios, it is very difficult to properly assign probabilities to potential outcomes. However, if we are able to claim that historical volatility indicates future variance (or, similarly, volatility or uncertainty is constant over time), we can use historical variance as our indicator of future uncertainty:

$$

\sigma_{H}^{2}=\sum_{t=1}^{n}\left(R_{t}-\bar{R}\right)^{2} \frac{1}{n}

$$